It’s Not Too Late!

Despite reports this morning that News Corp. has secured enough support from the Greedy Bastards Bloc of Dow Jones’ controlling Bancroft family, this fight is by no means over. The vote amongst the trustees is going to be close and the players could still switch sides, as many have been doing throughout the process. After the Bancrofts vote, the deal will be put before the rest of the shareholders later this fall. Today’s results are not determinative.

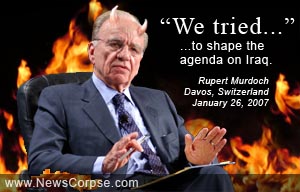

Rupert Murdoch’s latest ploy to tip the scales in his favor appears to be an outright bribe of wavering Class B shareholders, whom he has offered an extra $30 million dollars for their capitulation. But he cannot offer any such bribes to other retail or institutional holders.

There are heroes in this story who have demonstrated integrity and honor, notably Christopher Bancroft, Leslie Hill, and the Ottoway family, who have all been persistent opponents of this deal. But too many of the remaining clan are more concerned with fattening their wallets than preserving an American publishing institution. So if they are too consumed by their own avarice to act in the best interests of the treasure that has been bequeathed to them, it is up to concerned citizens to step in and make their voices heard. But “What can we do?” you ask.

If the Class B shareholder vote for control of Dow Jones exceeds 30% in favor of the sale, Murdoch still has to pull almost all of the non-family votes in order to prevail. It is generally presumed that this is a given, but several details make the outcome less clear. For one, many retail investors never vote in these elections, making it harder to achieve a majority which is based on the total shares, not the total of those voting. This would force Murdoch into an expensive campaign to solicit votes. Another factor is that the bulk of these shares are held by institutions and mutual funds. That’s where you come in.

The list below are the mutual funds with the largest holdings in Dow Jones & Co. If you see any funds in which you are invested, this would be a good time to contact the firm and let them know that you intend to divest your holdings unless they commit to vote their shares against the sale.

| Fund | % Held |

| T. Rowe Price Equity Income | 5.37 |

| Fidelity Capital Appreciation Fund | 3.40 |

| Hotchkis and Wiley Mid-Cap Value I | 2.77 |

| Fidelity Equity-Income II Fund | 2.50 |

| T. Rowe Price Mid-Cap Value Fund | 2.10 |

| Fidelity Equity-Income II | 1.93 |

| T. Rowe Price Mid-Cap Value | 1.79 |

| Goldman Sachs Mid Cap Value Fund | 1.70 |

| First Eagle Global A | 1.54 |

| T. Rowe Price Value Fund | 1.30 |

| Fidelity Advisor Equity Income I | 1.20 |

| JNL/Mellon Capital Management 25 Fund | 1.20 |

| Columbia Mid Cap Value Fund | 0.90 |

| Allianz OCC Value Fund | 0.80 |

| John Hancock Trust – Equity-Income | 0.70 |

| Wells Fargo Advantage Common Stock Z | 0.48 |

| Van Kampen American Value A | 0.44 |

| Aston/Optimum Mid Cap N | 0.39 |

| ING T. Rowe Price Equity Income S | 0.31 |

| Tocqueville | 0.30 |

Check your own portfolio to see if any of your funds are holders of Dow Jones. These funds have a fiduciary responsibility to vote in the best interests of all shareholders. Rupert Murdoch has not proven himself to be a sound financial manager in the U.S. newspaper business. His New York Post has lost money for as long as he has owned it. What’s more, another bidder for Dow Jones, MySpace founder Brad Greenspan, has promised to match Murdoch’s $60.00 bid while leaving the company independent and offering a proposal that forecasts a $100.00 share price. The Dow Jones board has failed to consider this offer.

You may be thinking that these big investment firms are not going to shift their investment strategies because you called to complain. That may be true for some, but customer service is a major concern of any retail business, and if enough customers express themselves, the company cannot ignore them.

More importantly, in the end it doesn’t matter that much if they do ignore you. When you divest your shares in the fund, the company can no longer vote them in the Dow Jones deal. If they end up not being voted at all, Murdoch’s majority is placed a little further away. And [This is important] the vote only needs to shift about couple of percentage points to sink the deal. With approximately 30% in play, this is entirely achievable.

If you believe in free, diverse, and independent media, this is the time to put your money where your ideals are. Feel free to reinvest the shares you withdraw in some nice little socially responsible mutual funds. If a people-powered movement can keep the WSJ out of Murdoch’s clutches, we can all feel proud for having been a part of it. And, in any case, you’ll sleep better knowing that you tried.