The Occupy Wall Street movement has had a profound effect on changing the topic of debate in this country. A couple of months ago the only subject the media would entertain was the national debt and federal spending. Today the conversation has veered to economic inequities and the abuse of corporate power.

An ancillary to the Occupy agenda that arose a few weeks ago is the call for Americans to Move Your Money from big, impersonal banks, to local community banks and credit unions. That initiative climaxed last Saturday as the day designated “Bank Transfer Day.”

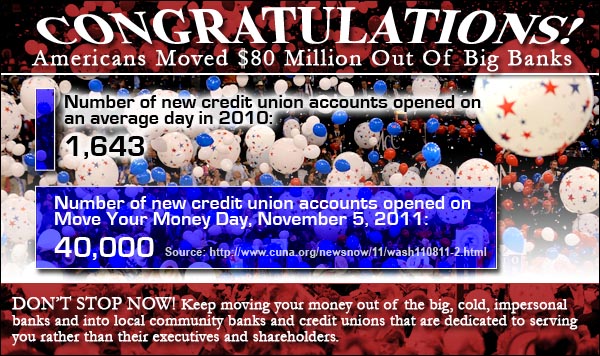

By any measure it was a resounding success. The Credit Union National Association reports that $80 million was moved into their member institutions on Saturday alone. For comparison, the CUNA notes that on an average day in 2010, they opened 1,643 new accounts. On November 5th, they opened 40,000 new accounts. Could anyone have predicted this level of success?

One person whose predictions were typically some distance from reality was Fox News’ Bill O’Reilly. Last Friday he engaged Geraldo Rivera in a debate that ended with a brief discussion of the Bank Transfer Day.

Rivera: “Tomorrow there’s a Bank Transfer Day. This is a concrete thing. They are saying ‘Take your money out of the Bank of America. Take your money out of J. P. Morgan Chase. Take your money out of these big banks and put them in small credit unions.’ What if that comes out to tens of millions of dollars in bank transfers?”

O’Reilly: Let me just tell you something. Nobody’s gonna do that. Number one, those people don’t have any money and nobody’s gonna listen to them because they lost credibility.

Ya think O’Reilly will acknowledge his error now that he has been proven to be a lousy prognosticator? Do you think he will address the fact that 650,000 new accounts were opened in the month prior to Bank Transfer Day? That’s more than the total number of new accounts opened in all of last year. Do you think the big banks will stop pretending they don’t care about customers fleeing because they aren’t profitable customers? Yeah, me neither.

Funny thing is I agree that the big banks are part of the problem – starting with the Federal Reserve, the biggest bank of them all.

However, as with all calls like this, do you really know the full impact of this kind of thing – i certainly don’t. All those average workers you so desperately want to protect, who do you think will feel it the most? Your hatred for “big business” ends up hurting the people you most want to protect.

I’m certainly not a fan of the banks and most of all the central bank who hurts you, me and everyone else with their mismanagement of our currency, but be careful what you wish for, you may just get it.

What are you talking about? How will it hurt average workers?

People do work at big Banks – so I guess they can lose their jobs so you can make a statement.

Why do you hate the free market, Steve?

If big banks lose business and lay people off, won’t the small banks and credit unions absorb those workers as they grow?

Why don’t you tell me what the real goal is instead of this BS you keep pushing. Is the goal getting the money and influence out of politics or is it to destroy this system because some leftist, commie types don’t like it and want it their way. If it’s about influence, destroying the banking system as it exists is irresponsible. If it’s because of hating “rich bankers”, which is what I believe it’s all about, then be honest. You’re not about a better America, you’re about a different America where we all get what crazies like you think is fair vs. what we can do to earn a living we want.

Good lord, $80 mil isn’t going to break the banks of America Steve. And you act like big banks can’t change the way they do business, like they’ll fail instead of adapting to the changing market. People are not happy with the way they do things, we feel like they rip us off every chance they get, so we’ll bring our money elsewhere. For all the love you have for American big business, you sure don’t have much for confidence in its agility. It’s not about anything other than how they do things now, getting OBSCENELY rich off of immoral and what is shockingly, not illegal practices. And we are showing them that that’s bad business.

Just thought this was worth looking at, not necessarily aimed at you Steve, just putting it out there in the first comment after I saw it.

The WallStreet Journal came out with an article stating the big banks do not mind losing customers. It stated the customers who left were not their main clientele. It save them the cost of doing more paper work and maintaining their accounts.

I know the WallStreet journal is just an extension of Rupert Murdoch. I just wanted to know your thoughts on this. It will take many more transfers to dishevel these Goliath companies.

In response to Steve, if the system fails due to action of disgruntled citizenry, then it is was not meant to be. What of it if our current social order topples? It will eventually be replaced with another, or humanity will find some other way.

It could just be that human beings were just meant to bring about an extinction event, where we were never meant to exist after our purpose was fulfilled.

I think what you may be deeply afraid of is a country spiraling into statism. If this is your fear, then fear no more. This has already come to pass.

You may not agree, but remember this. What is true for the whole is true for the one. Taking that into account no matter what you may think, the current system is defunct.

What Mark fails to point out is that this exodus from big banks to credit unions was already starting to happen. Bank of America was responsible for some of that with their attempt to charge debit card fees; the other banks refused to follow suit. The Occupy movemnet probably added a little bit of fuel to this exodus, but it was not the primary force.

Furthermore, dig a little deeper into the numbers, and you will see that this exodus hasn’t made a dent into the big banks’ market share.

Actually Steve, I did point out that customers were leaving the big banks prior to Move Your Money Day. I explicitly noted that 650,000 customers switched to credit unions the previous month. You should read more carefully.

Also, by Nov. 5, Bank of America had already announced that they were abandoning plans to charge a fee for debt card transactions. So that would not have been a primary cause for account transfers on Nov. 5.

Finally, you say further digging reveals that the big banks market share wasn’t dented, but you offer no support for that statement. If you really think that 40,000 lost customers in one day (690,000 in a month) doesn’t impact their bottom line, I guess you’re entitled to your opinion.

Bank of America was still having to deal with residual anger from their attempted debit card fee. People were still ticked off over this. If they hadn’t tried to enact this fee, that would have probably reduced the exodus from the jump.

And we have 300 million people in the USA. That should translate to tens of millions of people (at the least) who have bank accounts. So this exodus is still a drop in the bucket.