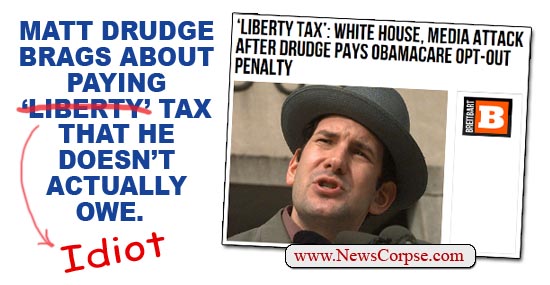

Anyone familiar with Breitbart News will not be surprised to learn that they did something stupid, again. After all, they are the geniuses who think that “E Pluribus Unum” is English. But their latest inanity stretches the boundary of blockheadedness even for them.

Be Sure To “LIKE” News Corpse On Facebook

The story began when conservative muckraker Matt Drudge boasted on Twitter that he had just paid what he called his “Liberty Tax,” a reference to the penalty for not getting health care coverage. The problem is that this fee is not payable until his 2014 taxes are due in 2015. Subsequently, Drudge was chastised by more knowledgeable people (e.g. almost anyone) who wondered whether he was deliberately lying or just ignorant.

Coming to Drudge’s defense is Matthew Boyle of Breitbart News. Boyle proceeds to back up Drudge by accusing his critics of not understanding how businesses pay taxes. So Boyle sets out to explain it to them and cites language from the IRS form for filing estimated taxes:

[S]ince he is self-employed as the proprietor of The Drudge Report, he files as a small business. According to the IRS’s website for self-employed individuals, they are required to pay taxes quarterly. […] So, when they file and pay those 2014 first quarter taxes, such individuals have to pay the Obamacare Individual Mandate tax if they opted to not have health insurance—like Drudge just did. […] Additionally, the IRS form (1040-ES) for estimating quarterly taxes specifically recommends adding the mandate penalty to line 12 for ‘other taxes’ — to pay before the first quarterly deadline of April 15.”

It’s true that some self-employed individuals are required to make quarterly estimated payments on their taxes. However, none of them are required to include the penalty for not getting health insurance until the following year. In fact, it says just that in the same paragraph that BreitBrat Boyle quoted only a portion of. Here is the whole paragraph:

“Health care coverage. When you file your 2014 tax return in 2015, you will need to either (1) indicate on your return that you and your family had health care coverage throughout 2014, (2) claim an exemption from the health care coverage requirement for some or all of 2014, or (3) make a payment if you do not have coverage or an exemption(s) for all 12 months of 2014. For examples on how this payment works, go to www.IRS.gov/aca and click under the ‘Individuals & Families’ section. You may want to consider this when figuring your ‘Other taxes’ on Line 12 of the 2014 Estimated Tax Worksheet. For general information on these requirements, go to www.IRS.gov/aca.”

Furthermore, Boyle’s defense is based on Drudge’s assertion that he is filing as a business, not as an individual. But what both Boyle and Drudge neglect to mention is that the mandate for businesses with fewer than 100 employees (which certainly includes Drudge) to provide health insurance to their employees was delayed until 2016. So no matter how you slice, Drudge has no tax liability for the coverage mandate in 2014.

So Drudge’s “Liberty Tax” really turns out to be an “Idiot Tax,” because he doesn’t actually owe it. If he did pay the penalty (which we don’t have any proof of) it’s his own ignorance of the law that is to blame, not ObamaCare. And Breitbart’s lame-brained attempt to rescue Drudge only proves that when dumb right-wingers do dumb things, other dumb right-wingers will jump at the chance to compound the dumbness. And dumbest of all is that Drudge is bragging about putting his health in jeopardy by not having insurance. He regards liberty as being at risk for devastating financial hardship that would ultimately fall to other Americans in the form of higher premiums and fees for services.

Switch to CREDO Mobile, the progressive cell phone company, today!

Further evidence of this cycle of stupidity is that Fox News featured this Breitbart story as the top headline on their lie-riddled Fox Nation website. And round and round it goes.

I’m so glad I’m reading this today because if it was reported on Fox the Republicans I work with will be spreading the word at the office tomorrow. At least I’ll be able to dispute it.

And that’s the whole reason I do this – so people will be able to rebut the right-wing nonsense with actual facts. Thanks.

Well it’s a daily battle for me so keep them coming.

The Liberty Tax should more appropriately be called the Suicidal Douchebag Tax; pay up boys and girls, rapture not included.

IRS’s bonehead defense of Drudge’s liberty tax?

http://www.irs.gov/pub/irs-pdf/f1040es.pdf

Page 2:

“(3)make a payment if you do not have coverage or an exemption(s) for all 12 months of 2014.”

“… consider this when figuring your “Other taxes” on Line 12 of the 2014 Estimated Tax Worksheet.”

Is the official IRS document for filing quarterly taxes for 2014 also propaganda that can’t be trusted?

Where should I get information if the IRS is part of the evil right-wing lies that can’t be trusted?

Weird the IRS document and Drudge agree the tax is due for quarterly taxes…

Clearly the IRS is lying and controlled by the right-wing, right?

Just like Breitbart, you are ignoring the beginning of that paragraph that says “When you file your 2014 tax return in 2015…”

you obviously don’t realize what estimated taxes are you pay them in advance, and if you are going to owe a penalty at the end, the IRS is clearly recommending that you pay it now, or else you will pay interest, like all estimated taxes.

LOL. You obviously dont have a clue about being a contractor. Independent contractors arent run like small businesses with employees…they file like a corporation, quarterly estimated taxes, but are treated like an individual by the IRS.

You left wingers are morons.

Actually, I AM an independent contractor, and you’re the moron.

Who’s the bonehead now? 😉

Even if Drudge is stupid enough to pay more than he owes by paying the penalty early, he will simply get a credit from the IRS for an over payment. If you do your own taxes and are too stupid to figure this out the IRS will do it for you. If he has an accountant do his taxes they will explain this to him but, of course, he will never correct his claim that he paid a ‘liberty tax’. He reminds me of the people who think their liberty is being taken away because they have to buy more efficient light-bulbs as the old inefficient ones were phased out. Michelle Bachmann actually made that claim!!! That would be like saying your liberty is being violated because you can’t buy lead-based paint anymore. The stupidity of these people is boundless!

After reading that nonsense – it’s quite obvious your life must be quite blissful!!

So a government forcing you to buy what THEY think is good for you, even if it isnt better, is not losing liberty? LOL

You are a mental midget.

I see you have chosen the Blissful life too – I don’t blame you, it’s much easier. Enjoy the peace you’ve found. The chains may get heavy at times, but at least you’ll feel happy.

Ajent Oranje – I may have misunderstood the direction of your response – sorry if I did.

Not being able to buy lead-based paint anymore . . . that’s one of the best comparisons I’ve heard in a long time.

Your wrong. The whole point is when you file your 2014 tax return in 2015 you will need to mark whether or not you have insurance. If you don’t have insurance you will have to pay a penalty. If you know ahead of time that you will not have insurance then the IRS instructions for the estimated taxes state that you might want to consider that and pay they penalty with your estimates.

Drudge knows he will not have insurance so is paying the penalty with his estimates like he is supposed to do. Also you are confusing the individual mandate with the employer mandate.

Nope, you’re wrong. Drudge is not paying the penalty like he is supposed to. He is paying something that is not due and that the IRS doesn’t even have a way of processing yet (call them, you’ll see).

And I have not confused the individual mandate with the employer mandate. I included both to cover all the bases so people like you wouldn’t accuse me of leaving it out.

Reviving the thread. Most of us pay taxes which are not due yet in the form of payroll deductions. As a self employed individual, Drudge pays his estimate quarterly while the majority of us pay our estimate weekly, sem-weekly, or bi-monthly. If the goal is to make the estimate as accurate as possible then Drudge has succeeded – to say this is stupid is just sour grapes on your part.