There has been, and will be, much discussion about the proposed merger between entertainment giants NBC/Universal and Comcast. Now that an agreement has been formally entered into, the discussions will likely become even more heated. Media reform advocates like FreePress are already organizing opposition to the deal. Free market capitalists want it to go through without interference from the government.

However, the government has a legitimate role to play to insure fair competition and to advance the interests of the public. Hearings will be held by the FCC, the FTC, and several congressional committees over the next year before the marriage can be consummated. Opponents will make the argument that a combined Comcast/NBCU would dominate access to entertainment programming and news on both cable and the Internet. Estimates show that Comcast, already the largest US provider of cable service and Internet access, would control up to 25% of all content. Comcast, on the other hand, will promise not to abuse their market position. If you’re naive enough to take their word for that, you might not think it’s such a bad deal. Unfortunately, Comcast has not been a particularly conscientious steward of the power they already have. And approving the merger would surely propel competitors to similarly bulk up to face the new, more scopious Comcast.

Ordinarily, I am a knee jerk opponent to any kind of media consolidation. The scope and reach of the Five Families of media (GE, Disney, Viacom, News Corp, and Time Warner) already wield far too much influence over everything we see, hear and read. I have long advocated breaking up these anti-competitive conglomerates and re-introducing real competition, independence, and diversity into the media marketplace. I still believe that deconsolidation is an achievable objective, though fairly far off on the time line.

In the meantime, what does this merger present to the current marketplace? Is Comcast really a worse partner for NBCU than GE, the world’s biggest defense contractor? Conflicts of interest in program content and distribution cause considerable harm, but is it any less harmful than conflicts that involve the production of military goods and weapons? GE’s reach extends even further into consumer products, financial services, information systems and health care technology. That’s a pretty broad scope for potential conflicts.

The Comcast merger offers some opportunities if implemented responsibly. Regulatory agencies can impose restrictions to prevent market abuse that would apply to all players, not just Comcast. They could mandate open access to airwaves and cable lines. They could codify network neutrality. They could promote localism to enhance the community service obligations that networks routinely ignore.

Comcast is already making noises about how they want to be better corporate citizens. They contend that they will comply with reasonable conditions set for the merger by the FCC and others. They promise that the corporate office will not influence news reporting at NBC or MSNBC. They vow to keep their content available to competing services like DirecTV. They have even taken a position in support of health care reform, explicitly repudiating the position of the US Chamber of Commerce, of which they are a member.

Of course, These may all be tactics designed to curry favor with the administration in hopes of clearing a path for approval of the merger. If so, that could also be an opportunity. The agencies and congressional committees reviewing the matter could extract significant concessions and make them binding for all of the monopolistic media enterprises.

Another somewhat more amusing benefit is the new relationship that would be forged between Fox and the NBC News unit. Bill O’Reilly and others at Fox have taken great pleasure in demonizing NBC and its current parent GE. For the most part they go after the executives because they are afraid to utter Keith Olbermann’s name aloud. O’Reilly has called GE’s CEO, Jeffrey Immelt, “a despicable human being” and has spewed impotent threats, saying…

“That Immelt man answers to me. . . . That’s why I’m in this business right now, to get guys like that.”

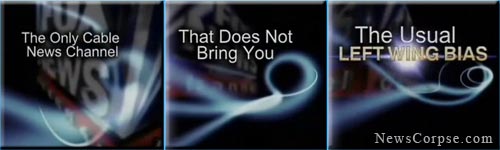

Um, OK. If you say so. So who will O’Reilly bash now? If he were to go off on Comcast CEO Brian Roberts, he might find himself regretting it. Comcast may decide that Fox News would be better off on a more expensive, upper tier, cable package. That could significantly reduce the number of homes that Fox would reach. Such a move would impact their ratings as well as their revenue from both advertising and cable subscription fees. Comcast might also decide that its new asset, MSNBC, would be a better fit on their basic cable packages, which it is not currently on in many markets. That obstacle to access has been a longstanding impediment to MSNBC’s ratings performance.

Like all bullies, O’Reilly is likely to keep his fat mouth shut about Roberts and Comcast. When there is really something at stake, he will cower in the corner and stick with his War on Christmas shtick. O’Reilly would never send Stuttering Jesse Watters to ambush Roberts. He’d rather stay comfy in his studio holding hands with Dick Morris as they demonstrate how little they know about any subject they address. And Roger Ailes and Rupert Murdoch would probably bury O’Reilly if he were to damage their relationship with the nation’s biggest cable operator. So maybe O’Reilly might actually have to confront Olbermann man to man. Although he would certainly lose that contest too.

In conclusion, I can’t get excited about another merger of big media megaliths. But I can’t really muster a great deal of antagonism about this one. I don’t see it as worse than the status quo, and I do see an opportunity to tighten regulatory oversight for the whole industry. That is, if the regulators and the administration have the will. Stayed tuned.