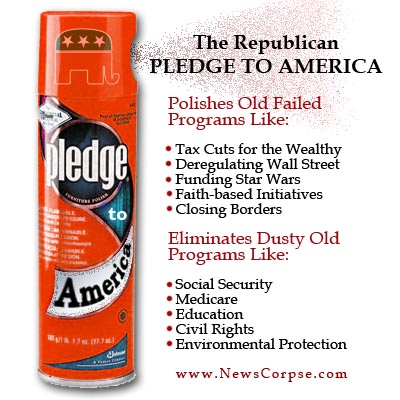

The Republican Pledge to America is just another lousy product from GOP, Inc. It is nothing more than a rehash of their failed programs from the past.

Already the reception the Pledge has received is decidedly negative – from both sides of the aisle. While Democrats correctly point out that the Pledge is old news and leftovers, Republicans like Erick Erickson and Neil Boortz are criticizing it because it doesn’t go far enough (into Delusionland). This Pledge has managed to disappoint everyone, and it did so by design. John Boehner, the Pledge’s Godfather, introduced the Pledge by saying…

Boehner: “We are not going to be any different than what we’ve been.”

That’s comforting. And to prove it, the Pledge’s development was overseen by a former lobbyist for some of the nation’s most powerful oil, pharmaceutical, and insurance companies. Same old same old GOP.

RoomRyan’s Roadmap Loses $2 Trillion In Revenue, Even Though 90% Of Americans Would Pay Higher TaxesBy Pat Garofalo on Mar 9th, 2010 at 6:30 pm Ryan’s Roadmap Loses $2 Trillion In Revenue, Even Though 90% Of Americans Would Pay Higher Taxes

When Rep. Paul Ryan (R-WI) recently released his Roadmap for America’s Future — a plan which purports to balance the federal budget over the next few decades without tax increases — conservatives leapt to embrace it. “I think it’s fabulous, it’s a great template for everyone that’s not just relying on smoke and mirrors,” said former Congressional Budget Office Director and McCain adviser Douglas Holtz-Eakin. “Halting America’s slide into bankruptcy and economic stagnation will require bold solutions like Rep. Ryan’s Roadmap for America’s Future,” added Rep. Tom Price (R-GA).

The plan relies on essentially privatizing Social Security and Medicare, while at the same time repealing the estate and corporate taxes and instituting a national sales tax (akin to a value-added-tax) of 8.5 percent. And while no marginal tax rates would be increased, according to a new report, the design of the plan and the taxes that Ryan leans on would shift the tax burden down the income scale, resulting in an overwhelming majority of Americans ultimately paying more in taxes than they do would under President Obama’s plans. Citizens for Tax Justice (CTJ) ran the numbers and found that under Ryan’s proposal:

– Federal taxes would be lower for the richest 10 percent, and higher for all other income groups, than they would be if President Obama’s proposals were enacted.

– The bottom 80 percent of taxpayers would pay about $1,700 more, on average, than they would if President Obama’s proposals were enacted.

– The richest one percent would pay about $211,300 less on average than they would if President Obama’s proposals were enacted.

– The poorest 20 percent would pay 12.3 percent of their income more than what they would pay under the President’s proposal, while the richest one percent would pay 15 percent of their income less than they would pay under the President’s proposal.

This shift in tax burden not only would force the middle- and lower-classes to pony up far more than the rich, but it would also result in the government collecting $2 trillion less over a decade than it otherwise would have. “It’s difficult to design a tax plan that will lose $2 trillion over a decade even while requiring 90 percent of taxpayers to pay more. But Congressman Ryan has met that daunting challenge,” CTJ wrote.

We’re already in an era in which the difference in tax burden between the wealthy and the middle class is smaller than at any time in history. Plus, as recently released IRS data shows, at the peak of the last economic cycle (2007) incomes for the top 400 households were at a record high while the taxes that they paid fell to a record low. (Of course, we would have known this earlier if the Bush administration hadn’t blocked access to the data on the top 400 taxpayers, which Obama once again opened up.) Ryan’s plan would exacerbate these trends.

To his credit, Ryan does try to grapple with long-term deficits (unlike most Republicans) and the Roadmap is a terrifyingly honest assessment of conservative priorities. But to take an already inequitable system and shift the burden further down is completely unacceptable, and it shows what passes for “

THIS IS THE SAME PLAN I READ AND PRINTED IN AUG. REPUB’S CAN KEEP THIS.

Class warfare won’t fix the problems…I’m not rich, but they (the “rich”) should be able to keep way more of their money than many people think. They certainly shouldn’t pay any more as a percentage of salary than the poorest actual tax payer in the US. It’s always easier to tell someone else to pay more taxes. Starve the Beast (ie the government). Drive a stake through its heart and kill it dead.

You’re assuming that there isn’t already class warfare – and the rich are winning.

The problem is that the rich now pay LESS as a percentage of earnings. Warren Buffet famously lamented that it was wrong that his secretary has a higher tax rate than he does. The rich have accountants and trusts and retirement savings and off-shore deposits and many other loopholes.

The tax rate for those making more than 250k would only be going up from 35% to 39%. That’s hardly a hardship, and it’s less than they were paying in the boom days under Clinton. Plus the 39% would would only kick in for income above 250k. That means that that the first 250k they make is still taxed at the lower rate. Do you really think that’s a problem? Especially when this small adjustment would decrease the deficit by 3 trillion dollars.

The rich can win – if they worked for it then they should be winning. why should the “losers” dictate how things go – typical liberal thinking. Destroy success in the name of “fairness” – that’s total BS in my view.

The rich aren’t winning because they deserve it. They are winning because they have all the power and they can buy the politicians who make laws that benefit them. You basically ignored every argument I made above.

Liberals love Warren Buffet except you all want his money to come to the government for redistribution….Actually you provide a good argument for a flat tax – people like Warren Buffet pay less as a percentage because of where they get their income. If you or he gets his income from dividends, it’s taxed at a different (and I believe lower) rate than how normal people like us who work 40+ hours a week. That is dumb – a flat tax on all income no matter what it is becomes “fair” and the liberal arch enemy the rich will pay the same % as you, me and the “lower income” people – of course they aren’t their arch enemy when contributing some of their wealth to their campaigns. Stop supporting the stealing of money from people for the “benefit” of the government. That’s the worst way to help people – it will result in less freedom for all and that I’m not willing to give up – you can if you want, but I won’t.

My simple answer to your question is yes – I think it’s a problem. Either I don’t understand your issue – which is very possible because some core beliefs of those who believe in “taxing the rich” more just never made sense to me in the first place. Sorry, I just can’t get my head around this line of thought – it makes zero sense to me. That’s not to say average people should pay more as a percentage of their income than anyone else. How much money do you think the government is entitles to from the upper income earners. 39% of everything above 250k is insane to me- it should go down in my opinion. The more yachts, planes and cars they buy, the more people work and get to earn a living. Those making under 250k can be taxed even lower too –

I think we’re good there.

Maybe the whole tax system is goofed up and that’s why it seems so inequitable to you. I would probably agree to a point – if every dime earned was taxed at a lower rate – the same across the board, it might be more equitable for all. Just because someone makes more, doesn’t mean they should be taxed at a higher rate – no way!

Glen Beck’s Rally in Seattle drew Protesters calling him a lair.

Beck lies is catching up with him which i knew they would one day.

Bob Woodword’s Book Foxnews is trying to make what woodword said a big deal, i say maybe Megyn Kelly and Fox and Friends should read what Bob said about G.W.B.

Woodword will say anything to sale a Book, just like the rest of those people at Foxnews.

I wish they would go further – to bad…

I would prefer Delusionland than Obama’s vision of America any day of the week.

Exactly! That’s the problem. Lots of people would prefer to be deluded than face a difficult reality (ignorance is bliss). That’s why Republicans are doing so well in the polls today. It’s what defines the Tea Baggers.

We liberals would rather deal with reality and solve real problems. That’s hard to do and it’s hard to explain. But it’s better than living in a fantasy world.

No Mark, reality doesn’t factor into liberal doctrine – There is absolutely no reason for the government to spend as much as it does unless you (general) believe the government should be “taking care” of people. It shouldn’t be as far as I’m concerned – at least not with respect to doling out money or having more social programs to the masses. If there are enough jobs, people can take care of themselves as they should. it’s not my job to pay for everyone else – I would bet that if you, me and everyone else was able to keep more of their money, more wealth could be created for the masses through the market – yes some will benefit more, but good for them. life’s NOT fair – that’s the way it is.

You’re the one who said you prefer delusion. Make up your mind.

And it seems to be OK with you if your parents or grandparents are forced to work into their 70’s or 80’s, whether or not they are physically able. And what about those who are handicapped and unable to work. You say “Screw ’em?”

Life isn’t fair. That’s why it’s so important for civilized people to show compassion and to support one another in the richest country in the world.

Civlized people do show compassion – on their own through their own choices every day – how did we ever survive all these years without government help??? My great-grandparents came from another country with NOTHING and somehow made it ok here – had a large family and actually fed them – how did that happen? Yes I would strip the federal government of most of it’s ability to run our lives.

One more time for everyone – Life’s not fair! sorry, that’s the way it is and I’m ok with that. i know the rules and adapt.

Thank you Ayn Rand.

btw: There would be no Internet for you to post that comment without the government.

Your welcome

Sincerely

Ayn Rand

I don’t want to argue with you – we just disagree on the role of governement – no different than the public in general. My bigger concern is the critical condition of our currency – you think it’s bad now, this will be a minor side show if our currency continues down its current course.