The Making of a Meme

Just in case anyone is wondering where Mitt Romney came up with the data behind the contemptuous affront he leveled at half of the population that he hopes to serve as president, it is a tenet of conservative philosophy that has been expressed repeatedly by pundits and politicians alike, although rarely with such disdain. Here is what Romney, a man who accuses President Obama of being divisive, told a roomful of wealthy donors:

“There are 47 percent of the people who will vote for the president no matter what. All right, there are 47 percent who are with him, who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president no matter what…These are people who pay no income tax.”

The erroneous charge concerning an alleged 47% of American freeloaders is one that has been exciting right-wingers for more than two years and has been notably championed by Fox News. To fill in the background of this story, I am re-posting an article I wrote in August of 2011 that describes the length and breadth of this fictitious political assault on the middle and working class of America. It illustrates explicitly the themes that Romney articulated to his wealthy supporters.

Debt Wish XI: The GOP/Tea Party Plan To Tax The Poor

(August 24, 2011) America’s Republican/Tea Party contingent, who are defined by their dogmatic devotion to lower taxes as a panacea for everything, have finally found a sector of society that they can comfortably saddle with a higher tax burden: The Poor.

That’s right. These anti-tax zealots have concluded that fairness cannot be achieved in the country’s tax code as long as there are disadvantaged freeloaders who are allegedly not paying into the system. While they fight tooth and nail to protect wealthy individuals and corporations from contributing even modest amounts to the nation’s recovery, the rightist brigade is marching lock-step in favor of soaking the poor in order to heal the malaise on Wall Street and the misery of long-suffering bankers. Their battle cry goes something like this: “Half of the Country Doesn’t Pay Any Taxes At All.” Fox News has been pushing that theme for quite a while. For the past two years they headlined it on Fox Nation right at tax time.

This movement is not some scruffy assemblage of disorganized trust-funders seeking to upgrade their yachts. It is a coordinated campaign that has pulled together high profile proponents from politics and the press. Here is a sampling of the breadth and unity of the movement and the message:

- Rick Perry (R-TX): We’re dismayed at the injustice that nearly half of all Americans don’t even pay any income tax.

- Michele Bachmann (R-MN): A system in which 47% of Americans don’t pay any tax is ruinous for a democracy.

- Sarah Palin (R-AK): The problem is more than 40% pay no income taxes at all.

- Orrin Hatch (R-UT): 51 percent don’t pay anything.

- Jim DeMint (R-SC): Over half of Americans pay no federal income tax.

- Mitch McConnell (R-KY): In fact, about half of Americans don’t pay any income taxes at all.

- John Boehner (R-OH): Fifty-one percent — that is, a majority of American households — paid no income tax in 2009. Zero. Zip. Nada.

- Eric Cantor (R-MD): We also have a situation in this country where you’re nearing 50 percent of people who don’t even pay income taxes.

- Alan West (R-FL): Currently we have some 40-45% of Americans who are not paying any taxes.

We’re not through yet.

- Donald Trump (R-HisOwnEgo): You do have a problem because half of the people don’t pay any tax.

- Bill O’Reilly (Fox News): 50 percent of Americans don’t pay any federal income tax now.

- Stuart Varney (Fox News): About half the people who work in America, half the households, actually, pay any federal income tax at all.

- Dave Briggs (Fox News): [A]lmost half of this country pays no income tax whatsoever.

- Gretchen Carlson (Fox News): But what does that mean when you factor in that 50 percent of the nation doesn’t even pay federal income tax? Is that fair?

- [Idiot Award Winner] Steve Doocy (Fox News): With 47% of Americans not paying taxes – 47% – should those who don’t pay be allowed to vote?

- Sean Hannity (Fox News): 50 percent of Americans no longer pay taxes.

- Neil Cavuto (Fox News): I’ve discovered nearly half of this country’s households don’t pay any taxes at all.

Oh yes, there’s more.

- Dave Ramsey (Fox News): This idea that 42% of Americans don’t pay anything…that’s just morally wrong.

- Brian Kilmeade (Fox News): Fifty-one percent of the country isn’t paying any taxes at all.

- Eric Bolling (Fox News): 43 percent of households don’t pay any federal tax.

- Glenn Beck (Right-Wing Radio): There was like 48 percent say they pay their right amount of taxes and 49 percent don’t pay any tax.

- Rush Limbaugh (Right-Wing Radio): Meanwhile, 45% of Americans pay nothing.

- Gary Bauer (Right-Wing Evangelist): But the reality is that nearly half of Americans don’t pay any income tax.

- Rick Warren (Right-Wing Evangelist): HALF of America pays NO taxes. Zero.

- Ted Nugent (Right-Wing Douchebag): This, of course, will not apply to those 50 percent of Americans who pay no income taxes.

Is there anyone who could seriously argue that this is not a coordinated effort aimed at demonizing low-income and working class citizens? The conformity and ubiquity of the identical messaging from such a broad spectrum of players is audacious and disturbing. And what’s worse, it is deliberately misleading and/or false.

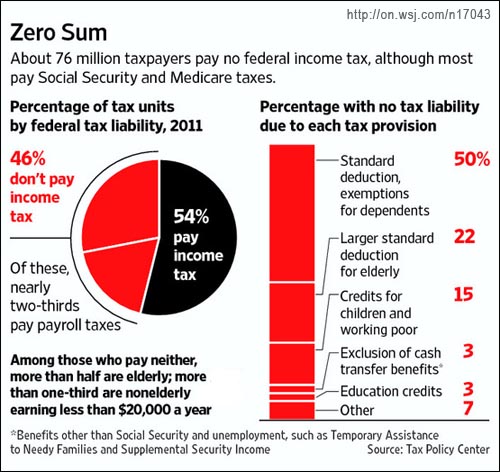

First of all, claims that half the population pay no taxes at all are factually wrong. (See the chart at the left from the Wall Street Journal). There are about 46% who do not pay federal income taxes, but most of them do pay many other taxes including Social Security, state and local, sales, property, gas, etc. Secondly, it should come as no surprise that those with little or no tax liability have little or no income. The majority of this group is comprised of senior citizens, students, the disabled, and the unemployed. Those are the folks that the right wants to tap for new revenue rather than the rich who they have taken to calling “job creators” despite the fact that they haven’t created any jobs since they got the Bush tax cuts a decade ago.

To put this into perspective, federal income taxes account for just 20% of all taxes. When you include all the other sources of tax revenue, people making $20,000 a year pay approximately the same effective tax rate as people making $500,000, give or take 5 percent. However, those earning a half-million have seen their rate decline almost 50% since 1980, while the rate for the 20K earners barely budged.

What’s more, corporate taxes as a percentage of federal revenue dropped from 27.3% in 1955, to 8.9% in 2010. During that same time period individual income/payrolls as a percentage of federal revenue skyrocketed from 58% to 81.5%. Thus the burden of paying for our government shifted broadly from corporations to ordinary people (notwithstanding the Supreme Court ruling that corporations are people). These facts prove that the whole faux controversy over the tax liability of low income Americans is, in technical terms, a crazy zombie lie.

Also worthy of note is that one of the main reasons that many Americans owe no federal income tax is due to the earned-income tax credit that was introduced by Republican President Gerald Ford and expanded by Ronald Reagan and George H.W. Bush. And now the GOP is threatening to impose a tax hike on working people by opposing the extension of President Obama’s Payroll Tax reduction. This relief was passed as a temporary measure and is set to expire at the end of this year. Obama has proposed extending it for another year, but House Republicans are balking, saying that “not all tax relief is created equal” (Rep. Jeb Hensarling, R-TX), and that tax reductions, “no matter how well-intended,” will push the deficit higher (Rep. David Camp, R-MI). Camp is a member of the deficit reduction seeking Super Committee. A spokesman for House Majority Leader Eric Cantor (R-VA), says the legislator “has never believed that this type of temporary tax relief is the best way to grow the economy.”

Really? Is this the same Eric Cantor who fought so fiercely for the temporary tax relief produced by Bush’s tax cuts for the rich? Cantor, and the rest of the Tea-publicans, are putting their deficit cutting necks on the line to raise the 120 billion dollars that would be restored to the treasury by letting the Payroll tax relief expire, but they will take the fight to Hell and back before considering the recovery of 800 billion dollars from the expiration of Bush’s gift to taxpayers earning more $250,000 a year. Apparently Republicans are opposed to temporary tax relief when it benefits the middle and working classes, but they are wildly in favor of it when it benefits the wealthy.

How can the GOP get away with portraying themselves as tax-cutters while advancing an agenda that would increase taxes for most Americans who happen not to be rich? How can the Tea Party assert through their acronym that they have been “Taxed Enough Already” when they view seniors, and other low-income Americans as not taxed enough? And when will the media expose this brazen hypocrisy?

So it’s clear that Romney was not speaking off the cuff in this newly released video. He merely reiterated what has been a mainstay of the conservative agenda for some time. If he tries to explain this away as a mistake or a gaffe, he is going to have to provide explanations for all of the identical statements itemized above. There is nothing out of character in the remarks he gave at his fundraiser. He is, after all, the same guy who said “I’m not concerned about the very poor.” He’s the same guy who said “If you’re looking for free stuff you don’t have to pay for, vote for the other guy.” His denigration of Americans struggling during hard time is entirely on message, just as RNC chairman Reince Preibus said following the release of the video.

The condescending tone of Romney’s comments is what is likely to cause the most damage to his campaign. But let us not forget that the substance of his remarks is consistent with Republican ideology, and it is woven intricately into the fabric of the party’s structure. It reflects the views of their congressmen and senators and state officeholders. And it flows through the airwaves of their PR division, Fox News, and down the media food chain from there.

[Update] Romney may want to do some research into those 47 percenters he is writing off. Of the ten states with the highest percentage of residents who pay no federal income tax, ten are solid red, Republican states.

Click chart to enlarge.

Click chart to enlarge.

The republican party in its current form is a stain on our democracy and a threat to its survival. They need to be defeated in this election cycle resoundingly, I believe, in order to save this country from their destructive ideology. They need to reject the tea party idealogues and bring some moderation and sense of compromise back to this party for the good of this country and its future.

I agree the current republican party is a mess, but it’s NOT because of conservative ideology – they don’t represent that at all anymore. Not sure what you’re seeing, but conservatism is NOT the republican party anymore.

Maybe your point is still partly correct in that the current republican party actually doesn’t represent anyone except their own desire to maintain some kind of power and only the blind republican voter keeps them going. The primary election victories of Mitt Romney make that crystal clear.

Steve reaches into the Con Playbook for the chapter entitled: Conservatism cannot fail; it can only be failed.

i know it’s beyond you to believe anythign other than government can make you successful, you must be on the bottom of the heap and can’t get yourself up – sad to be you.

Could you be wronger? And to think I almost didn’t check back in.

Cons make the unconscious assumption that their binary thinking applies to libs as well. Believe me or not, it doesn’t.

One thing I should mention, there hasn’t been any conservatism in government for some time – like since the mid 1990s – not sure how anything can be compared. Lots of promises though, just no delivery.

who said government. I said cons.

daphne – Its a bit unfair to shoot down his argument as being phoney prior to him even explaining his reasons for saying what he said.

Just an observation….

I agree with Randy and Steve what I hear and see on the streets and at work is most working class and poor republican-tea party folks is that they buy into this right wing garbage and will vote against their own best interest.Some because it’s racial some because they simply don’t know any better that Every talking head right winger is not even in their tax bracket They believe lies and propaganda that Fox and all these right wing talk radio shows are preaching the Obama is a Muslim a radical he raised our taxes knowing full well they got refund checks, earned income tax credits. Obama gonna take our guns.The worst lie is that most black people are on food stamps and welfare to lazy to get a job.

I’m not sure if you’re suggesting this, but this isn’t just a “republican” issue. Both Barak Obama and Mitt Romney are 2 sides of the same coin. Too many voters have their heads up their butts and are blind to the fact that neither party is in their best interest anymore.

On a side note – I met my first “Obama is a muslim” person yesterday – quite interesting.

http://www.salon.com/2012/09/18/a_uniquely_self_destructive_candidate/

Mark: have you seen this? The photo says a million words.

Thanks for that.

The best take I’ve heard yet on RMoney’s secret video confessions is by Ryan Grim of the Huffington Post. He notes that writing off the 47% is an admission that “trickle down” doesn’t work. If it did RMoney would take the argument to the 47% and try to persuade them that his tax cuts for the rich would help everyone, including those who currently pay no income tax. By dismissing them he’s admitting that he really doesn’t believe that crap.

Yes. I just saw an interview with Grim on one of my MSNBC shows. He pointed that out.

Great article on the Fox News echo chamber.

Small item –

You say in the 2001 article that personal income tax is only about 20% of Federal Revenue. I think its actually about 40-45%

http://www.taxpolicycenter.org/briefing-book/background/numbers/revenue.cfm

Actually, the article you linked affirms what I wrote: that individual income/payroll taxes account for about 80% of revenue. You are just counting income taxes alone.

The actual sentence that I was referring to is just below the “Zero Sum” chart in the 2011 article. It reads –

“To put this into perspective, federal income taxes account for just 20% of all taxes.”

I think that the 20% figure should actually be changed to 40% (or 42%.

The combined percentage for personal income taxes plus payroll taxes that you mention in your comment to me actually comes in the next paragraph.

Now I’m confused, because the link you included in your original comment referred to the individual income/payroll taxes, so I responded to that.

But if you’re disputing the 20% as the percentage of all revenue from taxes that comes from federal income taxes, you’ll have to take that up with the authors at the link I provided in the article.

OK – I see where he says that. I think he’s wrong.

I’ll take it up with him.

Its just a slip (IMO) that doesn’t weaken the overall point, but I think its too far off not to gloss over. Back to you later if I get an update….

My mistake – he (and you) are talking about Federal income taxes as a percentage of taxes of all kinds – Federal, State & Local.

I was reading it as a reference just to total Federal revenue.

Thank you for putting those remarks in context. It is just sickening that the NYTimes publishes garbage exonerating him.

http://www.nytimes.com/2012/09/18/opinion/brooks-thurston-howell-romney.html

“Personally, I think he’s a kind, decent man who says stupid things because he is pretending to be something he is not — some sort of cartoonish government-hater.”

No, he was being exactly who he is, and what’s really interesting but hasn’t been mentioned anywhere I’ve read about the video, his audience appeared to be in complete agreement.

Class warfare anyone?

Good points.

However, Brooks’ article was not exactly exonerating Romney by saying that he says stupid things and is cartoonish. If that’s the best he can do…

Just to chime in –

I’ve seen that as a normal strategy for Brook’s. He mixes mild criticism with something of a scold-apology-explanation, and then he wraps it up with an endorsement.

Its almost an attempt to “resolve” the matter so that it’s not worthy of further discussion. But he gets to take the event as evidence that the person (in this case Romney) is actually admirable.

**

Brooks did this a short while back when he explained that Paul Ryan didn’t vote for Simpson-Bolwes because Ryan though he could get an even better (for the country) tax and spending deal passed in the House.

Ryan failed to endorse Simpson-Bowles because he didn’t want ANY tax increases. But Brooks turned all the focus on the voucher system for Medicare (that Ryan also wanted).

Brooks says that the voucher idea is the best idea (but doesn’t say why) and he lauds Ryan for sacrificing the good for the better. But says that maybe Simpson-Bowlses should have been approved in committee just to get it to the floor for a vote.

In a sly way Brooks was forgiving Ryan, inoculating him from criticism, endorsing the voucher plan off-handedly, and obscuring the big issue of Republican stubbornness in terms of rejecting tax increases. All in one column.

Brooks entirely left out the fact that Ryan later attacked the President at the GOP convention for not doing more to advance Simpson-Bowles (after Ryan had helped block it).

I often feel that Brooks is being manipulative in his columns.

How’s that for a potential president? ‘I don’t care about half of the country that i’m campaigning to lead.’

I’d go further than Ryan Grim. It’s an inside look into what amounts to republican politicians using government to perpetuate the consolidation of wealth and power to the fewest among us, and to keep it that way. This is what confuses me…isn’t that a gross perversion of conservative principals?

P.S.

Steve, maybe you should consider that conservative principals and ideology are changing, or just aligning with the voices of the most extreme in which the GOP has put front and center. I’ve said it before, the way things are going, the GOP will fracture soon, and if there are many more conservatives that think like you do, that is to say that the GOP has forgotten true conservative ideology, it’ll happen. I’m curious, and I’m not trying to be confrontational here, when do you think the GOP lost its way? Before or after Obama?

I’m wondering if there is some truth there – I can’t say. I’ve been observing this behavior for some time – it’s been happening since way before Barak Obama. The best I can come up with is that something changed in the mid 1990s – 1994 was the last true conservative group (I’m basing that on the push toward a balanced budget, etc) I’ve seen come in. GW BUSH was the most obvious change – he was a total fraud with respect to conservatism and represents what the GOP has become. I keep voting for a change, but not enough others are so we’re stuck with this lot. I’ve become much more libertarian in my views given what I’ve seen from the two major parties – so maybe it’s more me changing and leaving the GOP behind.

You can’t all be missing the point, so my take is that your tangential arguments are intended to be intentionally distracting. You’re telling me that you are all OK with 47% of our citizens paying no federal income tax? And at the same time you are supporting the argument that the federal government needs to get even bigger? We already can’t pay for it (re: 47% of us are paying no federal income taxes) and you want to take more from those who are already carrying the burden of a bloated and inefficient machine? Holy cow- talk about heads in the sand.

While there are surely too many people hurting financially these days due to the state of the economy, the largest portions of that 47% are seniors, students, and people with disabilities.

So perhaps you’re arguing that all those lazy seniors should go back to work and that the students should drop out of school and get jobs. Or maybe you just think that all of these low or fixed income folks should be required to pay higher taxes, but that the rich should not have their rates increased just 4% (back to what it was in the booming Clinton years).

Yeah that makes perfect sense.

You continue to avoid the real point. We don’t have the money. Are there people that need help? Absolutely. Is the solution to continue to spend money we don’t have? We can’t continue doing that. Is the solution to confiscate the income of the wealthy? Okay, let’s go with that. Do you know how far that gets us? Nowhere. They don’t have $16 Trillion. So now what do you do? What’s your solution? Let’s hear it.

No you’re avoiding the real point.

In case you haven’t noticed (and obviously you haven’t), this article is not about solutions to the national debt. That’s what you might want to discuss, but this article is about how the media colluded with politicians to advance a dishonest representation of middle class taxpayers – and how Romney jumped on that bandwagon. You have completely ignored that and changed the subject. So stop whining about what you imagine to be “real” points.

However, just to humor you (even though I know it’s wrong to feed the trolls), the solution to the debt problem is a balanced program of budget cuts and revenue, along with expanding the job market to produce a broader base of taxpayers.

The right, however, is adamantly opposed to new revenue and they consistently block jobs bills. They will only agree to budget cuts that affect the lower and middle classes (never their benefactors in big business). Their uncompromising devotion to the rich and to destroying this president is what is doing so much harm to this country.

I’m not ok with it, yet it’s far from the fault of the 47%. And THAT’s the point.

You’re right. If we let the 47% out-vote us then it’s our own fault when the country goes bankrupt. And who’s going to help the 47% when that happens, anyway?

Its also not true that “47% are paying no Federal taxes”.

Anyone working is paying payroll taxes for SS and Medicare. As Mark notes in the article, those payroll taxes equal about 40% of total Federal tax revenue from all sources. And the working poor and the lower middle class are paying may other taxes (local state taxes, sales taxes, etc).

A key point is that the topic is being turned into a nebulous menace – the evil entitlements monster – poor people taking from more affluent people. But the realities – what is really happening – isn’t getting discussed.

Its a long-standing Fox news strategy to cast blame but not to offer solutions.

And how are you proposing to continue to support the 47% level? Does $16 Trillion in debt ring any bells with you? The “rich” can’t cover that. What’s your solution, really?

The rich can cover part of it, but we need to cut military and entitlement spending too. There is other government spending we can also cut.

Romney wants to cut taxes even more, maintain and even increase military spending and cut non-defense spending sharply.

I think Romney has the wrong mix, that’s why I support Obama.

Du-oh! Just realized that this blog is the perfect place to solicit bids on that piece of property I have on the coast of Florida. You folks will buy anything if my description makes it sound good. Never mind the obvious facts.

Riddle me this folks: what happens when 51% of us are taking out more than we are putting in? Can you do the math? How much longer until we go from the 47% to 51%? Hint: look at the rate this ratio has increased over the past 4 years.

Yeah, that would be bad. Which is why we need to continue to invest in creating new jobs and growing the economy.

Too bad the GOP is doing everything they can to prevent any of that.

Mark: you may have noticed the troll infestation of extremely sore losers taking it out on MMFA since Romney blew what was left of his chances in that instantly infamous recording. Looks like we’ve got our own set of bitter enders here as well.

Yep. They have a knee-jerk reaction to swing back at their favorite targets whenever they are backed into a corner.

Pot calling the kettle…

You folks probably still think there were only about 10,000 people in DC on 9/12/09. And that the 2010 mid-terms were a fluke. That’s fine- keep your heads in the sand. Only don’t keep asking for more of mine and my children and my grandchildren’s money to be spend on wasteful government enterprises.